A Wayfair credit card offers discounts at Wayfair stores and their partners through their online furniture and home decor store in the United States. The Wayfair credit card provides a variety of discounts, services, coupons, and codes, which will be of interest to the store’s regular customers.

Wayfair credit card financing on the Wayfair website requires credit card registration. You must register for the corporate credit card on the Wayfair website to receive it. This discussion will focus on applying for the Wayfair credit card at wayfair.com.

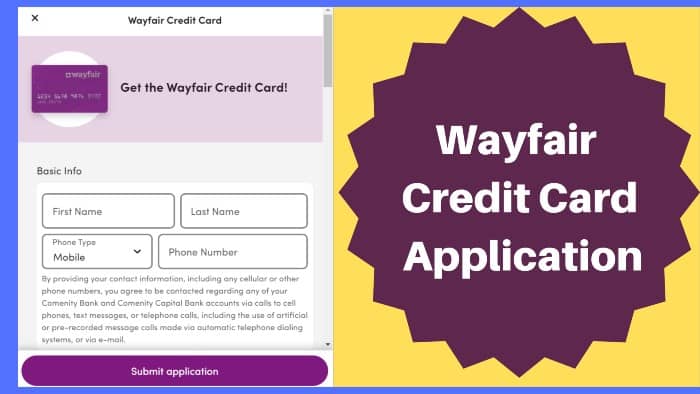

How To Apply For Wayfair Credit Card?

Follow the steps below to apply for a Wayfair credit card.

- You can access the official Wayfair Credit Card website via your web browser or the following direct link: www.wayfair.com/wayfaircard.

- On the Wayfair Credit Card page, you will see an Apply Now button on the top banner.

- By clicking the Apply Now button, a new page will open where you must enter your email address to create an account.

- Click Next after entering your email address.

- To create your account on the Wayfair portal, you must create a password.

- Enter your password and click the Create Account button to continue.

- You must enter your mobile number on the next page to verify your identity.

- To open the app, click Apply Now on the home page.

- The application window requires the following information: first name, middle initial, last name, email and phone number, complete address, residency status, monthly housing allowance payment, date of birth, social security, and total annual net income.

- Click Submit Request if you are satisfied with all the words.

- After completing the steps above, you will receive a confirmation email.

Fees For Wayfair Credit Card

The fees and rates for Wayfair Credit Card are listed below:-

- There is no annual fee for any credit card.

- The APR for purchase and balance transfer is 26.99% (variable).

- The minimum interest rate is $2.

- Cash Advance APR: 29.99%.

- You must also pay the transfer fee, $10 or 5% of the value of each transfer, whichever is greater.

- Additionally, there is a cash advance fee of $10 or 5% of each cash advance amount, whichever is greater.

- Foreign transaction fees are 3% of the purchase in US Dollars.

- The late fee can be as high as $40.